For decades, Medicare couldn’t negotiate drug prices - even when a single pill cost hundreds of dollars. That changed in 2022 with the Inflation Reduction Act. Starting January 1, 2026, Medicare will begin paying significantly less for 10 of the most expensive prescription drugs, thanks to direct price talks with manufacturers. This isn’t a small tweak. It’s the biggest shift in U.S. drug pricing in over 20 years. And it’s already lowering costs for millions of seniors.

What’s Actually Changing?

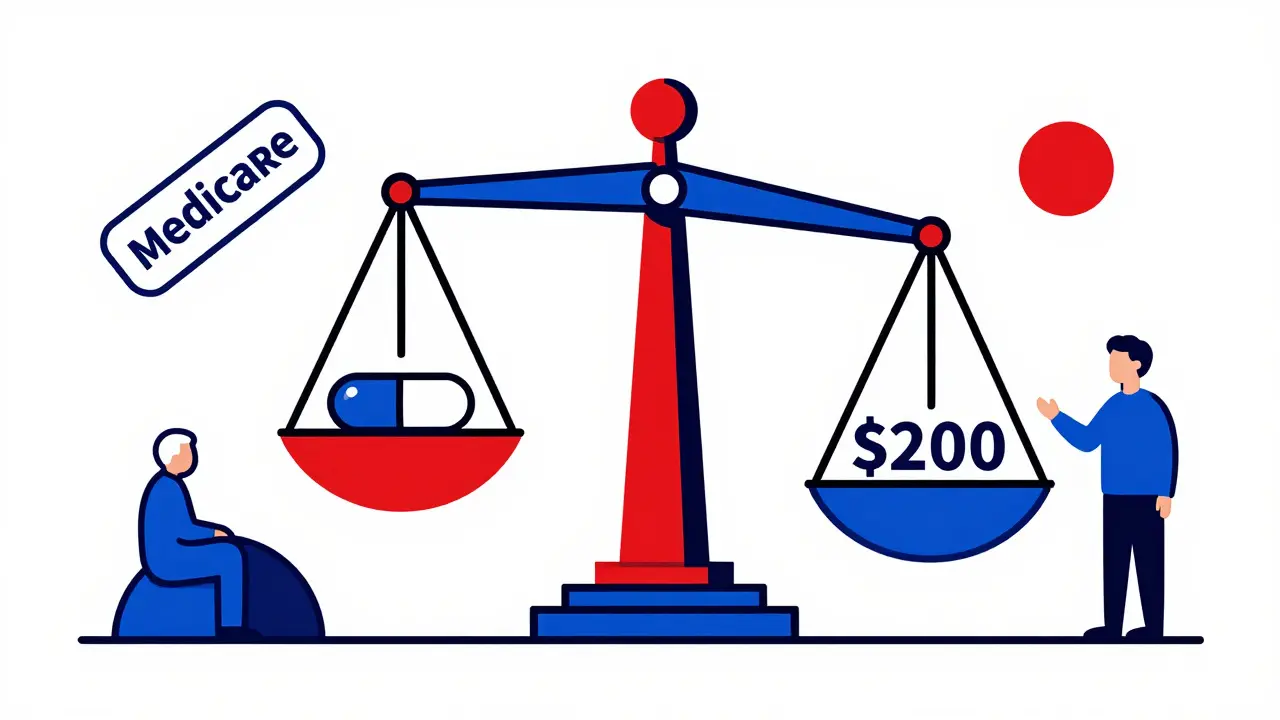

Before 2026, Medicare Part D - the prescription drug benefit - paid whatever drugmakers charged. Private insurers negotiated rebates behind the scenes, but Medicare itself had no power to ask for lower prices. The result? Americans paid more for the same drugs than people in Canada, Germany, or Japan. In 2022, Medicare spent over $50 billion just on the 10 drugs now being negotiated. Eliquis, a blood thinner, cost Medicare $6.3 billion alone that year. Now, the Centers for Medicare & Medicaid Services (CMS) can step in and say: “This is what we’ll pay.” They don’t ask. They negotiate. And they’re winning. For the first 10 drugs, discounts range from 38% to 79%. That means a drug that used to cost $1,000 a month could now cost $200. For people on fixed incomes, that’s life-changing.How the Negotiation Process Works

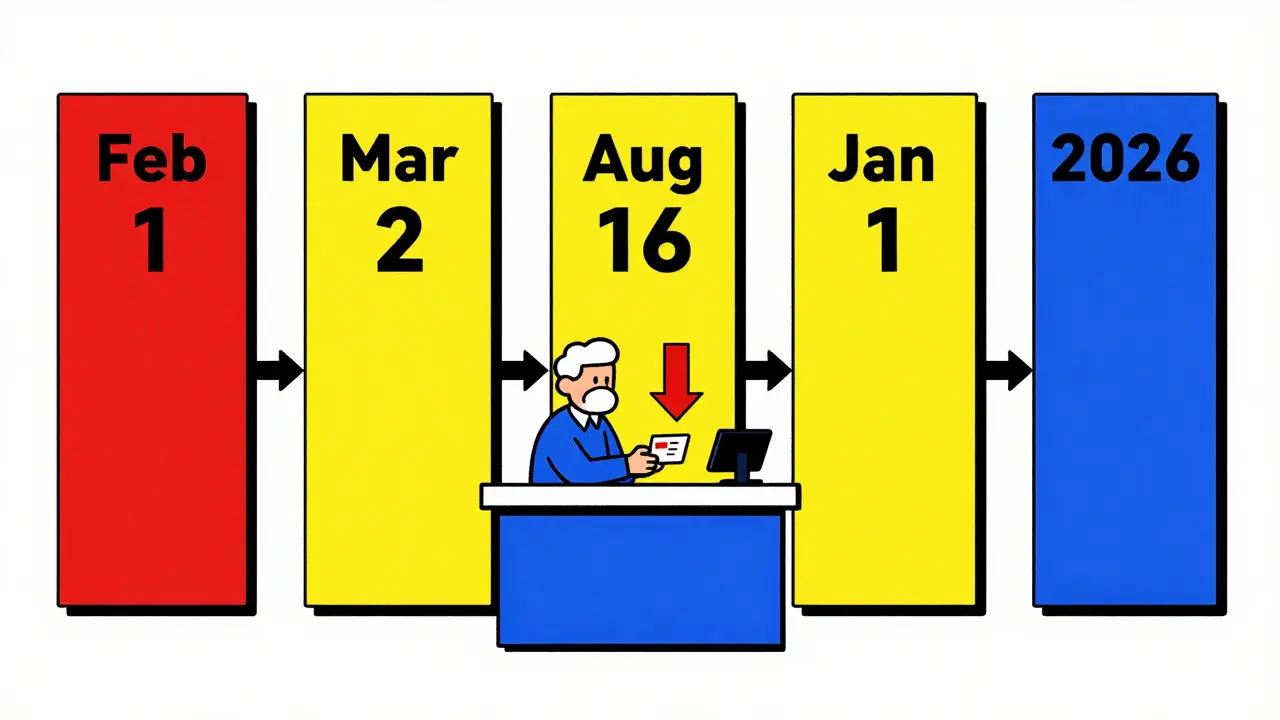

It’s not random. There’s a strict timeline, and every step is public. Here’s how it played out for the first round:- February 1, 2024: CMS sent each drugmaker an initial offer - based on what other countries pay, how much the drug is used, and what cheaper alternatives exist.

- March 2, 2024: Companies had 30 days to respond with a counteroffer.

- Spring-Summer 2024: CMS met with each company up to three times to discuss numbers. Some deals were settled in meetings. Others were finalized through written offers.

- August 1, 2024: The negotiation window closed. CMS announced the final prices on August 16, 2024.

- January 1, 2026: The new prices take effect. Pharmacies and insurers must use them.

Which Drugs Are Affected?

The first 10 drugs are all high-cost, single-source medications - meaning no generics or biosimilars are available. They include:- Eliquis (apixaban) - blood thinner

- Jardiance (empagliflozin) - diabetes and heart failure drug

- Xarelto (rivaroxaban) - another blood thinner

- Farxiga (dapagliflozin) - also for diabetes and heart health

- Stelara (ustekinumab) - used for psoriasis and Crohn’s disease

Why This Matters for Private Insurance

You might think: “I don’t have Medicare. Why should I care?” But you should. When Medicare negotiates a lower price, it doesn’t stay just for seniors. Private insurers often use Medicare’s prices as a benchmark. If Medicare pays $200 for a drug, a commercial insurer won’t pay $800. That’s called the “spillover effect.” Stanford Medicine estimates private insurers could save $200-$250 billion over the next decade because of these Medicare deals. That means lower premiums, smaller copays, and fewer surprise bills for people with employer insurance. Pharmacy benefit managers (PBMs) - the middlemen who handle drug pricing for insurers - are already updating their systems. A July 2024 survey found 78% of them had started training staff on the new Medicare pricing rules. That’s because they’ll need to adjust their own contracts with drugmakers to stay competitive.What About Doctors and Hospitals?

The changes aren’t just for pills you pick up at the pharmacy. Starting in 2028, Medicare will start negotiating prices for drugs given in doctor’s offices or hospitals - like cancer treatments or arthritis infusions. These are covered under Medicare Part B. Here’s the catch: Doctors used to get paid 6% above what they paid for the drug. So if a drug cost $10,000, they got $600 extra. That created an incentive to use expensive drugs - even when cheaper options existed. Now, they’ll get 6% above the new Medicare-negotiated price. That means less profit per drug. The American Medical Association estimates this could cost physician practices $1.2 billion a year in lost revenue. Some clinics may cut back on stocking certain drugs. Others may shift to generics or biosimilars.Who’s Opposing This - and Why?

Drugmakers aren’t happy. Four of the 10 companies sued to stop the program, claiming it’s unconstitutional. A federal judge dismissed those lawsuits in August 2024, but appeals are expected. The pharmaceutical industry claims the program will hurt innovation - arguing that lower profits mean less money for new drug research. But here’s the data: The U.S. spends more on drug R&D than any other country. In 2023, the top 10 drugmakers spent $80 billion on marketing - and only $42 billion on research. The Office of Management and Budget says industry claims about innovation loss are “significantly overstated.” Meanwhile, patients are largely supportive. A 2023 KFF poll found 72% of Medicare beneficiaries back price negotiation - 53% strongly. Groups like the Arthritis Foundation worry about losing access to specific drugs if insurers switch to cheaper alternatives. But the law requires that negotiated drugs remain on Medicare formularies. You won’t be forced off your medication.

What Comes Next?

The program doesn’t stop here. In 2027, CMS will negotiate prices for 15 more drugs. In 2028, another 15. After that, it’s 20 drugs every year. By 2030, over 100 high-cost drugs could be under negotiation. The eligibility rule is simple: A drug must be at least 7 years old (or 11 years for biologics) to be negotiable. That means brand-new drugs are protected - but once they age out, they’re fair game. The FDA has approved 1,432 small-molecule drugs since 2013. Only 382 of them are still single-source after seven years. That’s the pool. And it’s growing. The FTC is also cracking down on tactics like “product hopping” - when companies slightly change a drug just to block generics. That’s helping expand the list of drugs that can be negotiated.What This Means for You

If you’re on Medicare:- Your out-of-pocket costs for the 10 negotiated drugs will drop dramatically starting January 1, 2026.

- You’ll still pay your usual copay - but the base price just got much lower.

- You won’t lose access to your current meds. The law protects your options.

- Your premiums may go down over time as insurers follow Medicare’s lead.

- Your copays for common drugs like Eliquis or Jardiance could shrink.

- Pharmacies may start showing lower prices even if you’re not on Medicare.

- Help your loved one review their 2026 Medicare Part D plan options - new prices mean better deals.

- Ask your pharmacist if your medication is on the negotiation list.

Bottom Line

This isn’t theoretical. The discounts are real. The savings are already locked in. By 2026, Medicare will pay nearly half as much for 10 of the most expensive drugs in America. That’s not just a policy win - it’s a health win. The system isn’t perfect. There are legal battles ahead. Some doctors will adjust. Some companies will fight. But for millions of people who rely on these drugs, the change is simple: They’ll pay less. And that’s what matters.Will my Medicare Part D premiums go down because of drug price negotiation?

Not directly. Premiums are set by private insurers and based on overall plan costs. But as drug prices drop, insurers may reduce premiums over time - especially since they’re saving money too. The biggest immediate benefit is lower out-of-pocket costs for the drugs you take.

Can I still get my current prescription if it’s on the negotiation list?

Yes. The law requires that negotiated drugs remain on Medicare Part D formularies. Your doctor can still prescribe them, and your pharmacy can still fill them. The only thing changing is the price Medicare pays - which usually means lower costs for you.

Are these price cuts only for Medicare, or will they affect my private insurance too?

They’ll likely affect you too. Private insurers often use Medicare’s negotiated prices as a benchmark. If Medicare pays $200 for a drug, insurers won’t pay $800. This is already happening - and experts estimate private plans could save $200-$250 billion over the next decade, which may lead to lower premiums and copays.

What if my drug isn’t on the list yet? Will it ever be?

Yes - if it’s eligible. Only drugs that are at least 7 years old (or 11 years for biologics) and have no generic or biosimilar competition can be negotiated. CMS picks the highest-cost drugs each year. So if your drug is expensive and old enough, it will likely be added in future years - possibly by 2028 or 2029.

Do these price cuts mean drug companies will stop making new drugs?

Evidence doesn’t support that claim. The U.S. pharmaceutical industry spends far more on marketing than on research. The Office of Management and Budget found industry claims about innovation loss were “significantly overstated.” New drugs will still be developed - but the system will no longer reward companies for charging the highest possible price.

Comments (12)

Candice Hartley

January 26, 2026 AT 17:15

This is huge for my mom-she’s on Eliquis and just sighed in relief when she heard the price drop.

Paul Taylor

January 28, 2026 AT 03:59

Look I’ve been watching this play out for years and honestly the drug companies had it coming for decades

Medicare paying whatever they asked was insane

People die because they can’t afford pills that cost more than their rent

Now we’re finally seeing the government act like it’s supposed to protect people not corporations

And yeah the industry is screaming about innovation but they spent 80 billion on marketing last year

That’s more than they spent on actual research

If you’re making a drug that costs $1000 a month and there’s no competition you’re not innovating you’re exploiting

And now seniors are gonna get real relief

Not just a headline

Real dollars in their pockets

And guess what

Private insurers are already copying the prices

So this isn’t just a Medicare win

It’s a win for everyone who buys medicine in this country

Even if you think you’re safe with employer insurance

You’re not

You’re just one premium hike away from needing this too

Desaundrea Morton-Pusey

January 28, 2026 AT 04:16

So now the government is just telling companies what to charge

Next they’ll be telling you how many carbs you can eat

And who gets to breathe air

Typical socialist takeover

Murphy Game

January 28, 2026 AT 12:19

They’re not negotiating

They’re extorting

And you think this won’t backfire

Wait till the next cancer drug doesn’t come out because the FDA and CMS are too busy playing price cops

They’ll kill innovation

And then you’ll be begging for the old system back

They’re not saving you

They’re just making the system more broken

John O'Brien

January 30, 2026 AT 05:04

Bro this is the most legit thing to happen to healthcare in my lifetime

My aunt was skipping doses because Eliquis was $700 a month

Now she’s actually taking it

And yeah the pharma bros are mad

But guess what

They made billions off people’s suffering

Time to pay back some of that

And private insurance following suit

That’s the real win

Everyone’s gonna get cheaper meds

Not just seniors

And if you’re mad about it

Go cry to your stock portfolio

Kegan Powell

January 30, 2026 AT 12:50

Imagine if we treated medicine like a human right instead of a profit margin

That’s what this is really about

Not politics

Not ideology

Just basic decency

People are dying because a pill costs more than their phone

And now we’re finally saying enough

It’s not about punishing companies

It’s about stopping the exploitation

And the best part

It’s working

Prices are dropping

People are breathing easier

And the fear-mongering about innovation

Is just noise

They spent more on ads than on science

Let that sink in

And if you think this is the start of something bigger

You’re right

It’s just the first step

And we’re gonna keep walking

❤️

April Williams

February 1, 2026 AT 12:40

Why should I care if my neighbor gets cheaper drugs

What’s next

Free housing

Free food

Free everything

They’re turning America into a welfare state

And it’s disgusting

People need to work for what they get

Not have the government hand it to them

Harry Henderson

February 2, 2026 AT 16:43

THIS IS THE MOMENT

THIS IS WHAT WE’VE BEEN WAITING FOR

NO MORE EXCUSES

NO MORE BILLIONS TO PHARMA

JUST MONEY BACK IN THE POCKETS OF REAL PEOPLE

IF YOU’RE NOT CELEBRATING THIS

YOU’RE PART OF THE PROBLEM

SHARE THIS

TELL YOUR FRIENDS

TELL YOUR PARENTS

TELL YOUR DOCTOR

WE WON

AND WE’RE JUST GETTING STARTED

suhail ahmed

February 4, 2026 AT 13:50

From India where insulin costs less than a cup of chai

I’ve watched this with awe

For years we’ve seen Americans pay $1000 for pills we get for $10

Now you’re finally catching up

It’s not magic

It’s just fairness

And the fact that private insurers are already adapting

That’s the quiet revolution

They didn’t need to be told

They just needed to see a better price

And now they’re following

This isn’t socialism

It’s sanity

And it’s beautiful to see

May this ripple across the world

One pill at a time

astrid cook

February 6, 2026 AT 01:26

Oh please

They’ll just make the drugs harder to get

Wait till your pharmacy says ‘sorry we don’t carry that anymore’

They’ll switch you to some generic that doesn’t work

And then you’ll be blaming the government

But it’s not the government’s fault

It’s the greedy doctors and pharmacies

They’re the ones who’ll screw you over now

Andrew Clausen

February 7, 2026 AT 13:30

The Inflation Reduction Act does not grant Medicare the authority to negotiate drug prices; it authorizes the Secretary of Health and Human Services to do so under Title XVIII of the Social Security Act, Section 1846. The term 'negotiation' is a misnomer-this is a price-setting mechanism enforced by administrative rule. Furthermore, the claim that private insurers are 'following' Medicare's pricing lacks empirical validation. While some PBMs may reference CMS rates, there is no legal or contractual obligation to do so. The $200–250 billion savings projection is extrapolated from hypothetical modeling, not actual market data. The assertion that this policy will not reduce innovation is contradicted by economic theory: reduced profit margins disincentivize R&D investment, particularly in high-risk, long-term projects. The Office of Management and Budget's assessment is not peer-reviewed and ignores opportunity cost analysis. The claim that 'patients are largely supportive' is based on a single KFF poll with a margin of error of ±3.5%-not conclusive evidence of national consensus. This policy is not a win. It is a complex regulatory intervention with unintended consequences that remain unmeasured.

John O'Brien

February 7, 2026 AT 22:18

Andrew you’re the kind of guy who reads the terms and conditions before eating a sandwich

And then complains the bread has too many carbs

Real people don’t care about your citations

My aunt’s blood isn’t clotting because she can’t afford Eliquis

Now she can

That’s what matters

Not your grammar or your legal footnotes

Stop being a robot