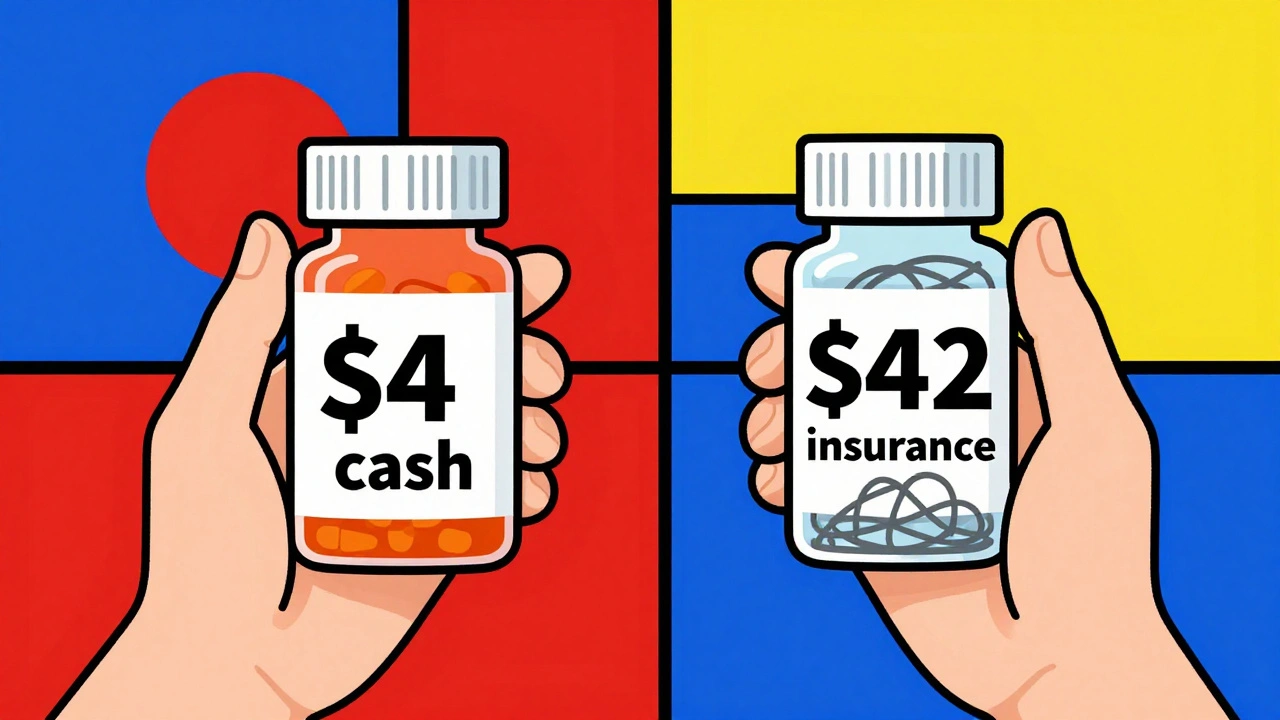

Ever bought a generic pill only to find out the same drug costs $4 at one pharmacy and $42 at another just down the street? You’re not alone. In the U.S., the price of generic medications can vary wildly - and most people have no idea why. The system is built on layers of hidden rebates, secret contracts, and confusing pricing tiers that leave patients guessing what they’ll actually pay. But tools exist to cut through the noise. You don’t need to be a pharmacist or insurance expert to find the lowest price. Here’s how real people are saving hundreds a year - and what’s still holding them back.

Why Generic Drug Prices Are So Confusing

Generic drugs are supposed to be cheaper. That’s the whole point. But in reality, the price you see on the shelf has almost nothing to do with what the drug actually costs to make. The list price - called the Wholesale Acquisition Cost (WAC) - is set by the manufacturer. But that’s not what pharmacies pay. Pharmacies get paid based on something called the Maximum Allowable Cost (MAC), which is set by your pharmacy benefit manager (PBM). And your out-of-pocket cost? That’s determined by your insurance plan’s formulary, your deductible, and whether your pharmacy is in-network. All of this happens behind the scenes. By the time you hand over your card at the counter, you’re basically flying blind.Even worse, some pharmacies will advertise a $4 generic price - but only if you pay cash. If you use insurance, the same pill might cost $25. And if you’re on Medicare, your plan might not cover that pharmacy at all. This isn’t a glitch. It’s how the system works.

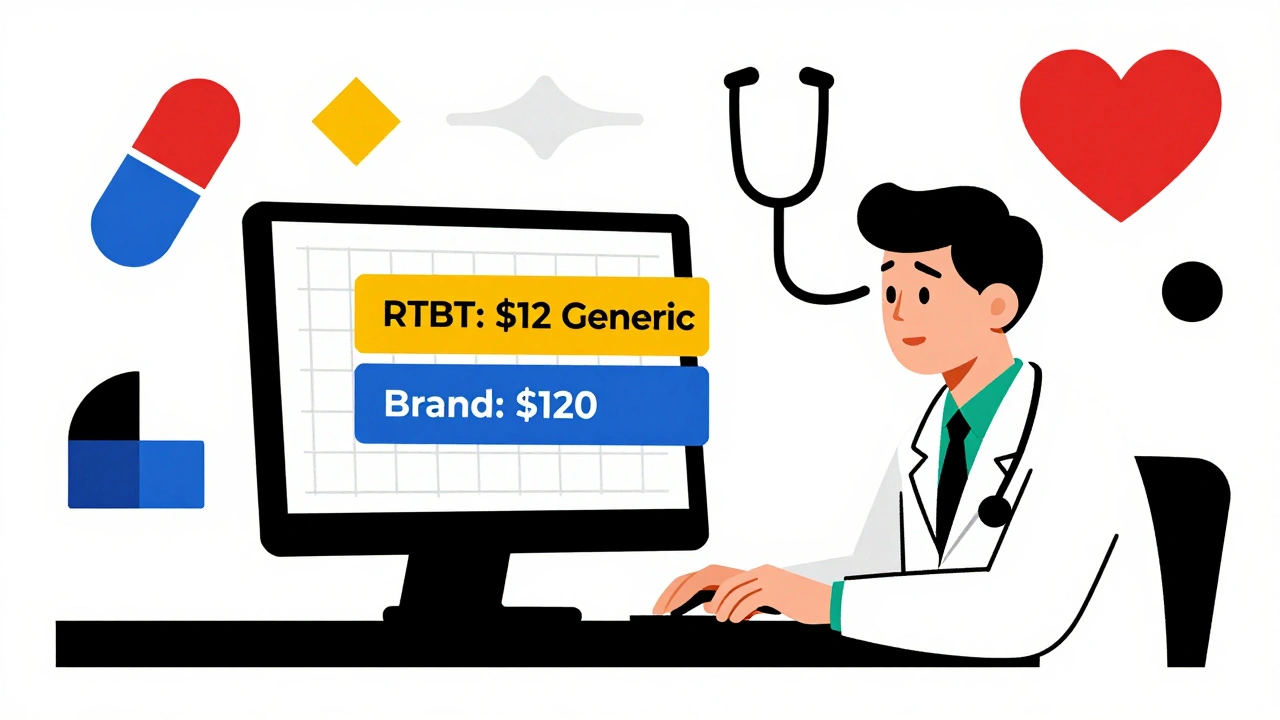

Real-Time Benefit Tools: What Doctors Use to Save You Money

The most powerful tools aren’t apps you download. They’re built into your doctor’s electronic health record. These are called Real-Time Benefit Tools (RTBTs). Platforms like CoverMyMeds and Surescripts connect directly to your insurer’s system. When your doctor types in a prescription, the system pulls up your exact cost-sharing amount - right then and there.One study showed that when doctors used RTBTs, patients switched to lower-cost generics 8.2% more often. That might not sound like much, but for someone on a fixed income, it could mean the difference between filling a prescription or skipping it. One physician in Ohio reported his patients’ out-of-pocket costs dropped by 37% on average after using the tool. How? He’d see that a $120 brand-name drug had a $12 generic alternative with the same coverage. He’d say, “This one’s covered at $12. Want to try it?”

RTBTs are now used in 42% of U.S. physician practices as of 2025 - up from just 15% in 2022. But they’re not everywhere. If your doctor doesn’t use Epic, Cerner, or another major EHR system, they probably don’t have access. Ask them. If they say no, you can still get the same info - just not as fast.

GoodRx and Other Consumer Apps: What They Can - and Can’t - Do

GoodRx, SingleCare, and RxSaver are the apps most people know. They show you cash prices at nearby pharmacies. And yes, they often find deals you wouldn’t see otherwise. In 2024, 43% of U.S. pharmacies accepted GoodRx discounts. That’s a big number. But here’s the catch: these tools don’t show your insurance price. They only show cash prices. And if your insurance is better than cash, you’re better off using it.Users report frustration. One Trustpilot review from March 2025 said: “The app showed $4 for my blood pressure med. I drove 20 miles. The pharmacy said their system said $15.” That’s because GoodRx negotiates discounts with pharmacies - but those discounts aren’t always active. Pharmacies can refuse them, or their system might be outdated. And if you’re on Medicare Part D, GoodRx often can’t be used at all.

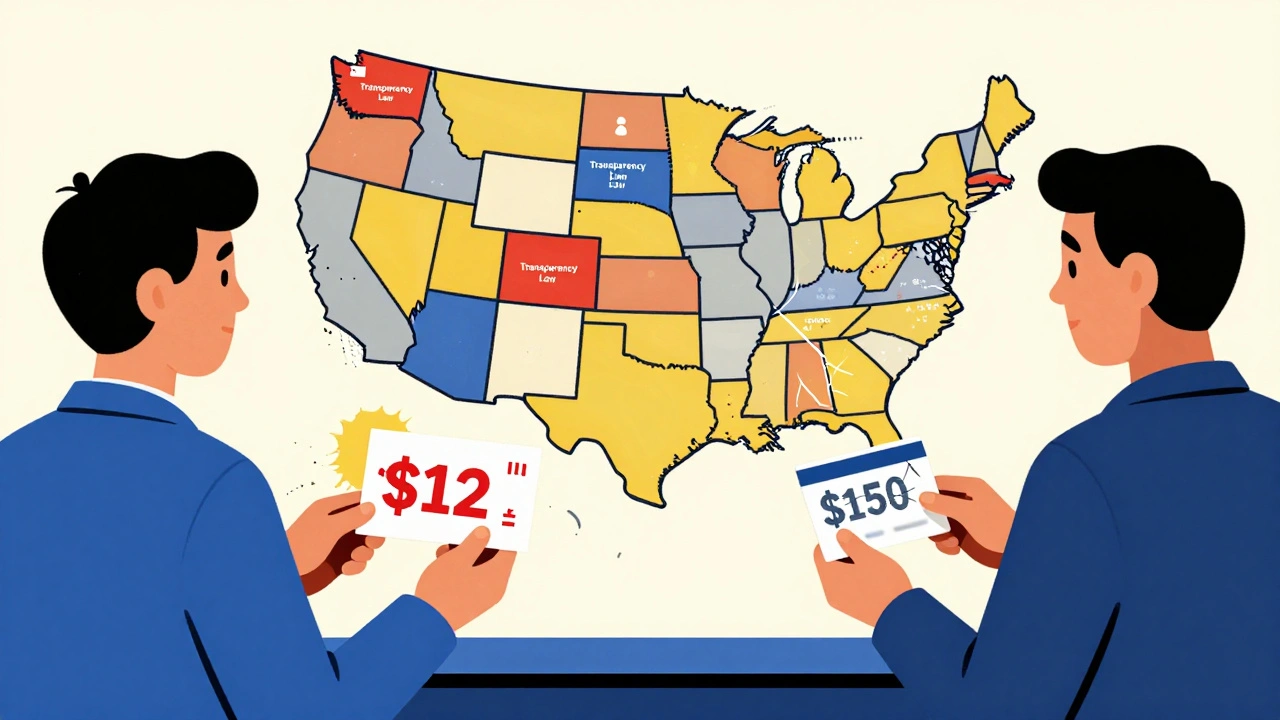

Still, for the 30 million Americans without prescription coverage - or those hitting their deductible - these apps are lifesavers. A Minnesota patient used GoodRx to find a $12 price for a generic statin. His insurance charged him $150. He saved $287 in a year. That’s not a fluke. It’s repeatable.

State Laws Are Changing the Game

Federal rules have been slow. But 23 states have passed their own price transparency laws as of April 2025. California requires drugmakers to report price hikes over 16% in two years. Minnesota created a Prescription Drug Affordability Board that can cap prices on high-cost drugs. And in Washington, pharmacies must now post their cash prices online - no more hidden fees.These laws aren’t perfect. Some don’t cover all drugs. Others don’t require net price disclosure - meaning rebates and discounts are still secret. But they’ve forced pharmacies and manufacturers to be more open. In Minnesota, a state-run portal lets you compare prices across pharmacies for the same generic drug. One user found a 92% difference between two stores just five miles apart. That’s the power of public data.

How to Use These Tools in Real Life

You don’t need to be tech-savvy. Here’s what works:- Before your appointment: Look up your medication on GoodRx or SingleCare. Note the lowest cash price.

- During the visit: Ask your doctor: “Is there a generic version? And can you check what it’ll cost with my insurance?”

- At the pharmacy: Always ask: “What’s the cash price? And what’s my insurance price?” Don’t assume the first price they give you is the best.

- If it’s too expensive: Ask if the manufacturer offers a patient assistance program. Sites like RxAssist.org list free or low-cost options for 1,200+ medications.

Doctors who use these steps report better patient adherence. Why? Because patients know what they’re paying before they leave the office. No surprises. No shame. No skipped doses.

What’s Still Broken

The biggest problem? Net prices are still hidden. Even if you see a $10 price on GoodRx, the real cost - after rebates paid to your insurer - might be $2. But you’ll never see that number. That’s because PBMs and insurers don’t want you to know how much they’re getting paid to cover your drug. They profit from the gap between what they pay and what you pay.That’s why some experts say transparency alone won’t fix prices. If the system rewards insurers for pushing expensive drugs with big rebates, then showing you a $10 price doesn’t change the incentive. It just makes you feel better about paying it.

What’s Coming Next

In January 2025, a new federal bill called the Drug-price Transparency for Consumers Act (S.229) was introduced. If passed, it would force drug companies to include the wholesale price in every TV ad. Imagine seeing “This pill costs $15 to make” right after the jingle. It sounds simple - but it’s a direct challenge to the current model.Also, CMS is expected to release final rules for the Prescription Drug File by the end of 2025. That could force insurers to report exactly how much they paid for drugs - net of rebates. If that happens, we might finally see the real cost of your medication.

Until then, the tools you have are enough. You don’t need to understand the whole system. You just need to know how to ask the right questions - and where to look.

Comments (10)

Paul Dixon

December 11, 2025 AT 01:12

I used GoodRx last month for my cholesterol med and saved $120. Drove to three pharmacies just to be sure - turned out the corner CVS had it for $8 cash. My insurance wanted $147. No joke. I felt like a detective, but hey, my wallet thanked me.

Now I check before every refill. It’s not perfect, but it’s way better than guessing.

Vivian Amadi

December 11, 2025 AT 10:22

Stop pretending this is a mystery. This is corporate greed wrapped in a PowerPoint slide. PBMs are the real villains. They take kickbacks from drug companies to push expensive meds. You think GoodRx is the solution? It’s a Band-Aid on a gunshot wound.

Doctors using RTBTs? Great. But why should patients have to beg for basic transparency? This system is broken. Fix it or shut it down.

Jimmy Kärnfeldt

December 11, 2025 AT 17:52

It’s wild how something so essential - your medicine - is treated like a luxury item you have to haggle for. I used to feel ashamed asking my doctor about prices. Like I was being cheap.

But then I learned it’s not about being cheap. It’s about being smart. And honestly? It’s not fair that you need a PhD in insurance jargon just to afford your heart pill.

These tools? They’re not magic. But they’re a start. And the fact that people are sharing them? That’s the real win.

We’re not supposed to need hacks to survive. But since we do… let’s keep sharing them.

Ariel Nichole

December 13, 2025 AT 16:47

I just asked my pharmacist last week what the cash price was and she looked at me like I’d asked for a unicorn. But she checked - turned out it was $11 vs $32 with insurance. I didn’t even know I could ask.

Thanks for the reminder. I’m gonna start doing this for my mom’s meds too. Small wins, right?

matthew dendle

December 14, 2025 AT 13:49

goodrx is a scam lmao

been there done that bought the tshirt

pharmacy says $4 then says oh wait no its 18 now

why do you think i dont trust tech bros

its all smoke and mirrors

Jean Claude de La Ronde

December 14, 2025 AT 22:08

Canada’s system isn’t perfect but at least I know what I’m paying before I walk in. No games. No ‘depends on your insurance’ nonsense.

Here in the US we’ve turned healthcare into a casino and everyone’s betting on the wrong number.

And now you want me to download an app to win? Nah. Fix the damn table.

Mia Kingsley

December 15, 2025 AT 11:36

OMG you think this is bad? Try being on Medicare and having your pharmacy say ‘sorry we don’t accept GoodRx’ then turn around and charge you $200 because your plan ‘has a tiered formulary’

IT’S A SCAM

AND EVERYONE KNOWS IT

WHY ISN’T THE GOVERNMENT DOING SOMETHING

JUST SAYING

Aman deep

December 16, 2025 AT 17:10

bro i came from india where we buy pills at local chemist for 10 rupees ($0.12) and here in usa same pill costs 30 bucks??

not even a joke

i used to think america was the land of innovation

turns out its the land of innovation in billing systems

but hey - i learned to use goodrx now

and i tell my friends - dont be shy to ask

your life > your pride

and if you cant afford your meds - you aint alone

we all been there

Sylvia Frenzel

December 16, 2025 AT 17:58

Why are we even talking about this? The government should just fix this. Not make people hunt for deals like it’s Black Friday. This isn’t a personal responsibility issue. It’s a national disgrace.

Regan Mears

December 18, 2025 AT 11:34

Just want to say - this post? Perfect. No fluff. Just facts. And the step-by-step? That’s gold.

I’m a nurse, and I give this exact list to every patient who looks stressed about cost.

One lady cried because she’d been skipping her diabetes med for six months because she thought it was $150 a month. Turned out it was $12 with GoodRx.

We need more people like you speaking up.

And to everyone else: don’t be afraid to ask. You’re not being difficult. You’re being smart.

And if your doctor says ‘I don’t have access to RTBT’ - ask them to call the pharmacy directly. Sometimes that’s faster than any app.