For most people, generic drugs are the reason they can afford their prescriptions. They’re cheaper, just as effective, and approved by the FDA. But if you’ve noticed your monthly pill cost suddenly jumping from $5 to $50, you’re not imagining it. Generic drug prices don’t move in a straight line. They spike, crash, and sometimes vanish entirely - all within a single year.

How Generic Drug Prices Actually Work

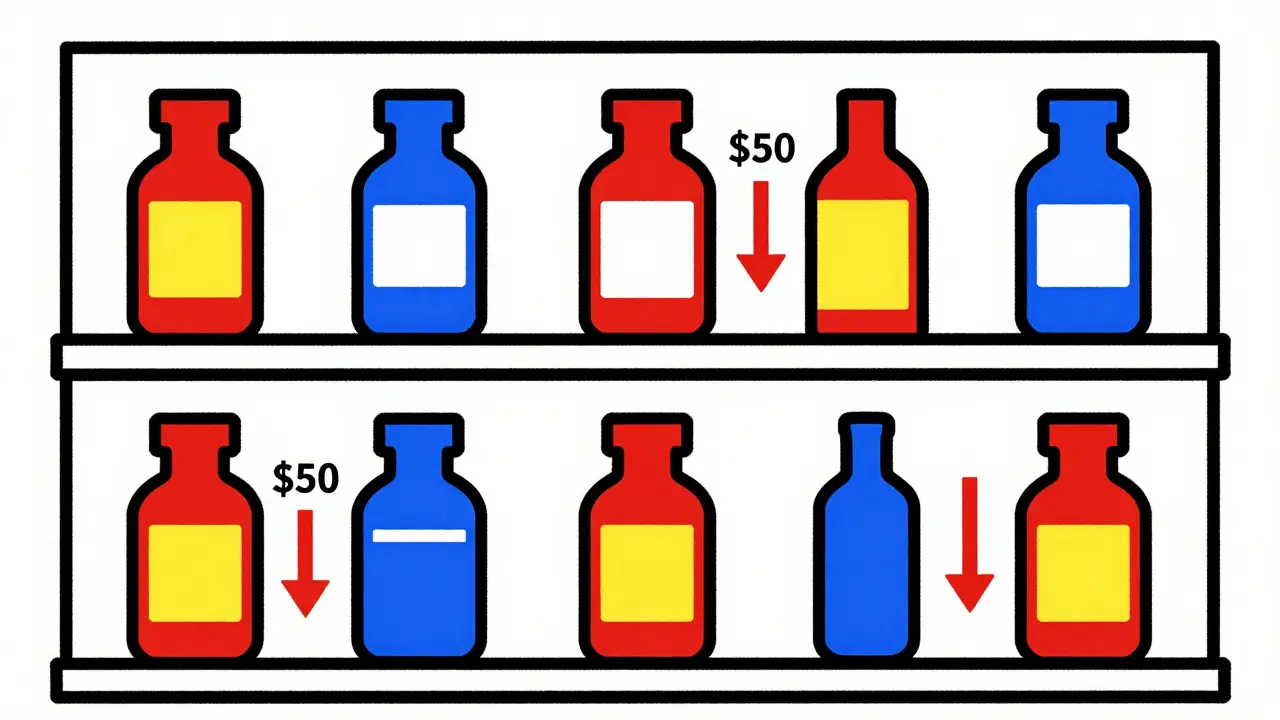

When a brand-name drug’s patent expires, other companies can make the same medicine. At first, prices drop fast - often by 90% - when the first few generics hit the market. That’s the theory. But in practice, it’s messy. If only one or two companies make the drug, prices stay high. If five or more are competing, prices collapse.

Take nitrofurantoin, a common antibiotic for urinary infections. Between 2013 and 2018, its generic price jumped over 1,200%. Meanwhile, levothyroxine, used for thyroid problems, dropped 87% over the same period. Both are generics. Both treat common conditions. But one became unaffordable, the other a bargain. Why? Competition. Or lack of it.

Here’s the rule: one generic maker? Price stays at 90% of the brand. Two makers? Drops to 65%. Three? Down to 52%. Four or more? Price plummets to just 15% of the brand. That’s not theory - it’s data from the FDA. The problem is, most generic drugs today have only one or two makers. And when one of them quits making it? Price skyrockets.

Year-by-Year Price Swings: The Real Story

Looking at the average price of all generics might make it seem like costs are stable. But averages lie. In 2023, the overall list price of generics rose just 4.9%. Sounds low, right? But during that same year, 40 different generic drugs saw price hikes averaging 39%. Some went up over 100%. Others dropped 20%.

Medicaid data from 2013-2014 showed that 8.2% of generic prescriptions had price surges between 100% and 500%. That’s not rare. It’s normal in markets with few suppliers. And it’s happening again. In 2022-2023, lisinopril - a blood pressure drug - jumped 247% at Walmart. One patient went from paying $4 to $45 a month. That’s not inflation. That’s market failure.

Between 2018 and 2020, the FDA approved over 2,400 new generics. That should’ve driven prices down. And it did - for some. But 40% of those approved generics had three or fewer manufacturers. That means they’re sitting ducks for price spikes. The FDA itself says markets with three or fewer makers are fragile. One company leaves, and prices explode.

Why Some Generics Are Always Cheap - And Others Are Not

Not all generics are created equal. Cardiovascular drugs like atorvastatin (Lipitor generic) or metoprolol are made by dozens of companies. Their prices are rock-bottom - often 12% of the brand. But central nervous system drugs like gabapentin or sertraline? Fewer makers. Prices hover around 25% of the brand. And they’re more likely to spike.

Why? Manufacturing. Some drugs are harder to make. They need special equipment, strict quality controls, or complex chemistry. Fewer companies can produce them. That’s why drugs like cyclosporine or minocycline - used for transplants and acne - see wild price swings. They’re not rare. They’re just hard to produce.

And then there’s the supply chain. In 2023, 23% of foreign generic drug factories failed FDA inspections. When a plant in India or China gets shut down for quality issues, the drug disappears from shelves. Price jumps. Patients panic. Pharmacies scramble. It’s happened with antibiotics, heart meds, even insulin generics. One factory outage can ripple across the entire U.S. market.

Who’s Behind the Price Spikes?

It’s not big pharma. It’s not the pharmacy. It’s consolidation. In 2013, there were about 150 companies making generics. By 2018, that number dropped to 80. Today, the top 10 manufacturers control 70% of the market. The top five? They control over half of all generic sales.

When there are only a handful of players, they don’t compete - they coordinate. Not always illegally, but always predictably. If one company raises prices, others follow. If one quits, the rest raise prices to make up for lost volume. The FTC has 12 active investigations into this right now. They’re looking at price hikes over 100% in markets with three or fewer makers. Over 65% of those spikes fit that pattern.

It’s not just about greed. It’s about economics. Making a generic drug costs less than $100,000 to get approved. But if you’re one of only two companies making it, you can charge $500 a bottle and still make money. Why lower it? Because no one else can.

What’s Changing in 2025?

Something new happened in January 2024. The Medicaid program removed the cap on rebates manufacturers must pay. Suddenly, 20+ brand-name drugs dropped in price. But generics? Not so much. Why? Because the rebate system doesn’t apply the same way. Generic makers don’t get the same financial pressure to cut prices.

The FDA is trying to fix this. Their 2024 plan targets drugs with few competitors. They’re speeding up approvals for those - aiming for 20% faster reviews. The goal? More makers. More competition. Lower prices.

The FTC is also stepping in. They’re now tracking price changes in real time and flagging markets with fewer than three manufacturers. If a company raises prices by 100% and there’s no competition? Expect a call from federal investigators.

But here’s the catch: even if more companies start making a drug, it takes 18 months on average to get it to market. So today’s price spike? It might not fix itself until 2026.

What This Means for Patients

If you take a generic drug, you’re not safe just because it’s not brand-name. You’re safe only if there’s competition. If your drug costs less than $10 a month, you’re probably fine. If it’s over $50? You’re at risk.

Here’s what you can do:

- Check GoodRx or SingleCare before filling your prescription. Prices vary wildly between pharmacies.

- Ask your pharmacist: “Is there another generic version of this?” Sometimes different manufacturers have different prices.

- If your price jumps more than 50% in a year, call your doctor. There may be a therapeutic alternative.

- Use mail-order pharmacies. They often get better bulk pricing on generics.

- Sign up for manufacturer coupons. Some generic makers offer them, even if they’re not brand-name.

And if you’re on Medicare? You’re not alone. In 2024, 37% of seniors on generics reported skipping doses because of cost. That’s not just inconvenient. It’s dangerous.

Why This Matters Beyond Your Wallet

Generic drugs saved the U.S. healthcare system $2.2 trillion between 2008 and 2017. That’s more than the GDP of Norway. But that savings is fragile. If 10% of generics - the ones with the most volatility - keep spiking, they could eat up half of all future generic savings.

Right now, generics make up 90% of prescriptions but only 23% of drug spending. That’s the magic ratio. But if that 10% of high-cost generics keep rising, that ratio could shift. Soon, we might pay more for generics than we think.

It’s not about whether generics work. They do. It’s about whether they stay affordable. And right now, the system is broken - not because of bad science, but because of bad competition.

What’s next? More price shocks. More pharmacy headaches. More patients choosing between food and medicine. Unless more makers enter the market - and stay in it - this won’t get better.

Why do generic drug prices go up even when they’re not brand-name?

Generic drug prices rise when there are few manufacturers making the drug. If only one or two companies produce it, they can raise prices without losing customers. Competition drives prices down - no competition means no pressure to keep prices low. This is especially common for drugs that are hard to manufacture or have low profit margins, so few companies bother making them.

Are generic drugs still cheaper than brand-name drugs?

Yes, but not always by much. On average, generics cost 80-85% less than their brand-name versions. But in markets with little competition, some generics now cost 50-70% of the brand price - still cheaper, but not the deep discounts people expect. A few have even reached 90% of brand prices, especially when supply is tight.

Which generic drugs are most likely to spike in price?

Drugs with three or fewer manufacturers are at highest risk. Common examples include nitrofurantoin, minocycline, cyclosporine, and certain heart medications like amiodarone. Also, drugs that are hard to make - like those requiring sterile manufacturing or complex chemical processes - tend to have fewer makers, making them more vulnerable to price hikes.

Can I switch to a different generic version of my drug?

Yes, if your doctor approves it. Generic versions of the same drug are chemically identical, but different manufacturers may use different inactive ingredients. For most people, switching is safe. But for drugs with narrow therapeutic windows - like warfarin or levothyroxine - even small changes can matter. Always check with your doctor or pharmacist before switching.

Why do pharmacies charge different prices for the same generic drug?

Pharmacies buy drugs at different prices based on their contracts with wholesalers and manufacturers. Some get bulk discounts, others pay list price. Plus, pharmacies often set prices based on what the market will bear - not what they paid. That’s why GoodRx often shows lower prices than your local pharmacy: they negotiate directly with manufacturers and pass savings to you.

What should I do if my generic drug price suddenly jumps?

First, check GoodRx, SingleCare, or Blink Health for lower prices. Then ask your pharmacist if another manufacturer’s version is available. If that doesn’t help, talk to your doctor about alternatives - there may be another generic or even a different drug that works just as well. Don’t skip doses. If cost is a barrier, ask about patient assistance programs - many generic makers offer them.

If you’re taking a generic drug, treat it like a stock - monitor its price. Don’t assume it’ll stay cheap. Stay informed. Stay proactive. And don’t let a price spike force you to choose between your health and your budget.

Comments (15)

Vinayak Naik

January 5, 2026 AT 16:17

Bro, I took nitrofurantoin last year and got billed $87 for 30 pills. My pharmacy said it was "the new normal." I thought generics were supposed to be cheap?? Now I check GoodRx like it’s my crypto portfolio. 😅

Kelly Beck

January 7, 2026 AT 04:15

OMG YES THIS IS SO REAL 😭 I had to switch my thyroid med because levothyroxine jumped from $12 to $65 in 6 months. My pharmacist was like "just try a different brand"-but they’re ALL the same chemical! Why does it feel like we’re being held hostage by a handful of factories in India?? 🙏 We need more makers, not more corporate silence.

Isaac Jules

January 8, 2026 AT 08:10

Stop pretending this is a "market failure." It’s corporate collusion. 10 companies control 70% of the market? That’s not capitalism-that’s a cartel. The FTC is slow, the FDA is toothless, and patients are the collateral. If you’re not angry, you’re not paying attention.

Pavan Vora

January 8, 2026 AT 11:35

Actually, you know, the problem is deeper… like, really… the supply chain… it’s not just about manufacturers… it’s about the FDA inspections… and the fact that 23% of foreign plants… failed… last year… so when one shuts down… boom… no more pills… and then… prices… go… crazy…

Indra Triawan

January 8, 2026 AT 14:11

It’s not about drugs. It’s about control. The system was designed to make us dependent. We think we’re saving money with generics… but we’re just trading one cage for another. The real medicine? Awareness. And maybe… rebellion.

Susan Arlene

January 9, 2026 AT 21:36

i just check goodrx now before i even leave the house. sometimes the same pill is $4 at cvs and $50 at walgreens. it’s insane. i don’t even trust my pharmacist anymore. they just shrug. like, what can they do? nothing. we’re all just guessing.

Mukesh Pareek

January 9, 2026 AT 23:11

Market concentration index exceeds 0.8 in 68% of high-volatility generic segments. Herfindahl-Hirschman Index (HHI) thresholds indicate highly concentrated oligopolies-clear violation of Sherman Act §1. Regulatory capture is evident. The FDA’s expedited review pathway is insufficient without mandatory transparency in manufacturing volume disclosures.

Leonard Shit

January 10, 2026 AT 15:01

my dad skipped his blood pressure meds last month because the price doubled. he didn’t tell anyone. just… stopped. i found out when he passed out at the grocery store. this isn’t a policy issue. it’s a human tragedy. and we’re all just scrolling past it.

Gabrielle Panchev

January 12, 2026 AT 02:28

Wait-so you’re saying that when there are only two companies making a drug, they don’t compete? But that’s… like… basic economics? Isn’t that called collusion? And yet, we act like it’s normal? Like, why is this even a surprise? We’ve known this for decades. The system isn’t broken-it’s working exactly as intended.

Melanie Clark

January 13, 2026 AT 21:49

Did you know the same factories that make your generic heart meds also make the pills for the Chinese military? And the FDA doesn’t inspect them properly? And the CEOs of these companies donate to both parties? This isn’t about prices… it’s about war. And we’re the battlefield.

Wesley Pereira

January 14, 2026 AT 09:00

Y’all are missing the point. The real fix isn’t more manufacturers-it’s more transparency. If we could see exactly which company makes what, and where, and when they shut down… we could predict the spikes before they happen. We need a public dashboard. Like stock tickers… but for pills.

Ashley S

January 14, 2026 AT 16:58

People just need to stop taking so many drugs. If you’re on 10 generics, maybe you’re just unhealthy. Stop blaming the system. Take a walk. Eat less sugar. You’d be fine.

Jeane Hendrix

January 15, 2026 AT 19:06

So if a drug has 3+ manufacturers, it’s stable? But what about when they all get bought by the same parent company? Like, technically different brands, but same owners? Is that still "competition"? I feel like the data doesn’t capture the real corporate web behind this.

Katelyn Slack

January 16, 2026 AT 06:08

my pharmacist said she’s seen 12 different manufacturers of metoprolol in the last year. one week it’s $7, next week it’s $45. she says they just swap the label. no one knows what’s coming. it’s like playing russian roulette with your meds.

Saylor Frye

January 18, 2026 AT 01:48

Wow. So the solution is… more generics? That’s it? We’re just gonna fix a broken system by adding more players? What about the 2-year approval lag? The $100k cost? The fact that most generics are made in countries with zero labor protections? You’re romanticizing capitalism like it’s a TED Talk.